On May 1, 2006, the Canadian Child Support Guidelines will be updated with significant amendments.

Among the most important of these changes is that the child support tables have been revised and monthly basic support payments will be increasing.

The amendments will also affect how the Courts determine whether certain kinds of discretionary extraordinary expenses will require contribution by a support payor. In particular, expense claims for primary and secondary education costs and extracurricular activity expenses will be affected. Claims for day-care, medical and post-secondary education costs are not affected by the amendments.

TABLE AMOUNTS TO CHANGE

The monthly "basic support" tables have been updated, and. the required basic support amounts will be increasing as of May 1, 2006.

For example, the monthly child support payable by an Ontario parent of two children will increased as follows:

Income ------New Guidelines------------ Current Guidelines

$50,000 ----------$753.00 -----------------------$700.00

$70,000 ----------$1029.00---------------------- $927.00

$100,000--------- $1404.00--------------------- $1240.00

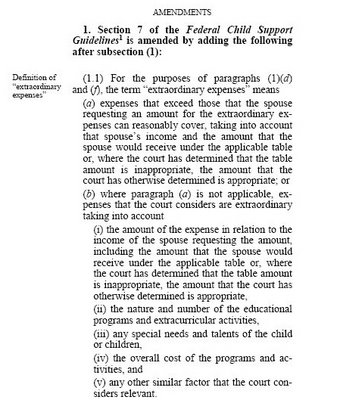

EXTRAORDINARY EXPENSES - Section 7 of the Guidelines

The new version of Section 7 gives Courts much increased flexibility in determining whether certain extraordinary expenses will require additional financial contribution by a support payor.

The new Guidelines will affect claims for contribution by a payor to extraordinary expenses for:

- primary or secondary school education or for any other educational programs that meet the child's particular needs, and

- extraordinary expenses for extracurricular activities.

This "reasonable coverage" requirement may well impose a new threshold or test for determining whether additional contribution to an expense is required.

At the very least, the Courts are to be given a widened discretion by this amendment.

While this may be seen as codifying a discretion that has to some extent already been exercised, it does open up a significant statutory front for resistance by payors to claims for contribution toward the specified extraordinary expenses.

The new Section 7 is reproduced below:

These amendments do not affect the requirement of contribution for day care and child care expenses, medical and dental expenses, or the costs of post secondary education. These expenses will continue to be assessed, taking into account:

- the necessity of the expense in relation to the child's best interests

- the reasonableness of the expense in relation to the means of the spouses and those of the child, and

- the family's spending pattern prior to the separation.

http://canadagazette.gc.ca/partII/2005/20051214/pdf/g2-13925.pdf#page=356

No comments:

Post a Comment